Alleged details of iOS 17, the launch of Apple's long-awaited savings account, and the release of the new Steve Jobs book "Make Something Wonderful," and more, all on this week's episode of the ╠ăđ─Vlog Podcast.

It's been a busy week of rumors and your hosts discuss an alleged list of what's coming in iOS 17. At the same time, it looks like Haptic buttons won't be happening after all, though the separately-rumored programmable mute button might be useful.

Next, newly-discovered code plus an active backend seem to show Apple that could launch its Savings account as soon as Monday. There's no debate here — both Wesley and Stephen will happily take advantage of the service whenever it becomes available.

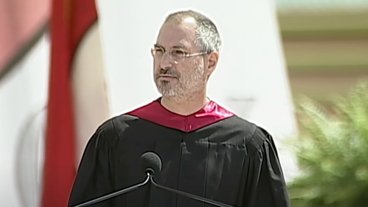

This week also saw the release of a book that collects a series of Steve Jobs quotes and images was released. As good as "Make Something Wonderful" is as a book, your hosts discuss their hope for a documentary about Apple's founder on Apple TV+.

Contact our hosts

Sponsored by:

- : Get a FREE one-month trial with access to the entire Headspace library! Visit to learn more.

Links from the show

- There is a free book about Steve Jobs life and accomplishments

- iOS 17 allegedly detailed by anonymous leaker with little new information

- iPhone 15 Pro may not get solid-state buttons due to technical issues

- Physical iPhone 15 Pro mockup shows rumored features

- Apple's long-awaited Savings account may launch on April 17

- YouTube adds SharePlay support for Premium members

- New Max' streamer combines HBO Max and Discovery+

- Former Apple PR head Katie Cotton has passed away

Support the show

Support the show on or to get ad-free episodes every week, access to our private Discord channel, and early release of the show! We would also appreciate a 5-star rating and review in

More ╠ăđ─Vlog podcasts

Tune in to our podcast covering the latest news, products, apps and everything HomeKit related. Subscribe in , , or just search for HomeKit Insider wherever you get your podcasts.

Subscribe and listen to our for the latest Apple news Monday through Friday. You can find it on , , or anywhere you listen to podcasts.

Podcast artwork from . Download the free wallpaper pack

Those interested in sponsoring the show can reach out to us at: steve@appleinsider.com

Subscribe to ╠ăđ─Vlog on:

Keep up with everything Apple in the weekly ╠ăđ─Vlog Podcast — and get a fast news update from ╠ăđ─Vlog Daily. Just say, "Hey, Siri," to your HomePod mini and ask for these podcasts, and our latest HomeKit Insider episode too.If you want an ad-free main ╠ăđ─Vlog Podcast experience, you can support the ╠ăđ─Vlog podcast by subscribing for $5 per month , or if you prefer any other podcast player.

Wesley Hilliard

Wesley Hilliard

-m.jpg)

Andrew Orr

Andrew Orr

William Gallagher

William Gallagher

Malcolm Owen

Malcolm Owen

Oliver Haslam

Oliver Haslam

Marko Zivkovic

Marko Zivkovic

8 Comments

"Nobody uses savings accounts anymore."

lol. I have the standard 6 months living expenses for my family of 3 in a high-yield savings account (~3.5%) which is currently earning about $1300 a year in interest. Highly liquid, instantly available in the event of an emergency or other sudden household need, without having to raid the much, much larger amount of money I have in a range of investments where cashing out can involve tax complexities and lost earning opportunities, and certainly better than leaning on usurious consumer debt. The right financial tool for the job.

I have no idea of Apple's savings account will make any sense for me compared to existing options (if it's anything like the Apple Card, probably not), but more options in the marketplace are always welcome.

Like someone else said: Think before you type. Financial diversity is the key to staying ahead of life's challenges and setting your own priorities instead of being at the mercy of others'.